Leipzig, 08/06/2022. ALVARA | Digital Solutions successfully supports retail companies to handle their cash management. The corresponding processes of preparation, counting and processing are usually not only complex for retailers, but also time-consuming and cost-intensive. They also deal with the challenge of reliably protecting cash from theft and fraud at all times. Manual processes and Excel spreadsheets no longer adequately reflect the tasks required for this. With Retail 360 from ALVARA | Digital Solutions, numerous retail companies are already using web-based software to manage their vaults. This way, they can meet current and future requirements.

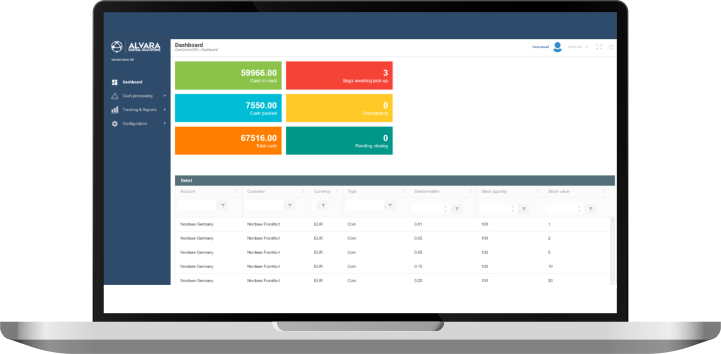

With its sophisticated functions tailored specifically to retailers, the solution manages to make cash management noticeably more efficient. “Retailers can see the turnover and its distribution among the means of payment and cashiers in a clear dashboard at any time,” says ALVARA | Digital Solutions Managing Director Steven Schwarznau, describing the advantages of the application. “The total amount of cash in the vault, the number of Safebags waiting to be collected, as well as the number of counts to be performed and daily discrepancy amounts can also be seen here at a glance. The connection to ALVARA ICC also enables a company-wide evaluation and a fully digitalized process with the value service provider.”

Sales are displayed in a clear manner by presenting transactions by booking date, branch, department, cashier, means of payment (credit card, cash, check, voucher, etc.), theoretical amount (POS) or recognized amount. More transparency is provided by the management of the cash balance, which can always be clearly assigned to a cash register or a cashier. “Whether it’s coins, banknotes, foreign currency, vouchers or checks: Our customers can manage all payment transactions in a clear manner. Thanks to immediate counting, deviations are immediately made apparent to every cashier,” explains Steven Schwarznau.

In stock management, Retail 360 also supports the visualization of cash stocks and updates these automatically – for example, after the preparation of the cash stock, the counting in the branch and the collection or delivery of cash by a CIT. In reporting, retail companies use customized reports and the export of data to the accounting / ERP software.

The exact daily sales for all means of payment are integrated into the accounting software. At the same time, Retail 360 determines where the gaps are between POS turnover (theoretical turnover) and the turnover actually counted (recorded turnover). The solution automatically integrates data from the POS software and collects counting results for non-electronic payments such as cash, checks and vouchers to identify discrepancies at the cashier level. All non-electronic means of payment can be tracked to ensure transparency for vault entries and withdrawals as well as cash receipts and payments.

As a result, retailers benefit several times over with Retail 360. The basis of a central database enables access to real-time data from any location. “Thanks to the flexible integration, the ALVARA software applications can also be adapted to the individual processes and requirements at the retailers,” Steven Schwarznau summarizes. All cash transactions and activities in the vault area are centrally managed including integration of POS data, counting, packing, petty cash, stock management in several currencies, data export and reporting of all means of payment. A quick identification of cash discrepancies for each cashier and for the different means of payment is possible. All internal and outgoing cash and transaction streams are fully traceable. Real-time monitoring provides insights into stocks, income and safe inventory of the individual branches at any given time.

The connection to ALVARA ICC also enables the monitoring of all cash logistical processes of the CIT up to the transfer to the bank account: The solution efficiently steers and documents the cash cycle between financial, trading and value services companies. The ordering process can also be easily digitalized with ICC.

Further information:

https://www.digital.alvara.eu/retail-360/

https://www.digital.alvara.eu/interactive-cash-control/